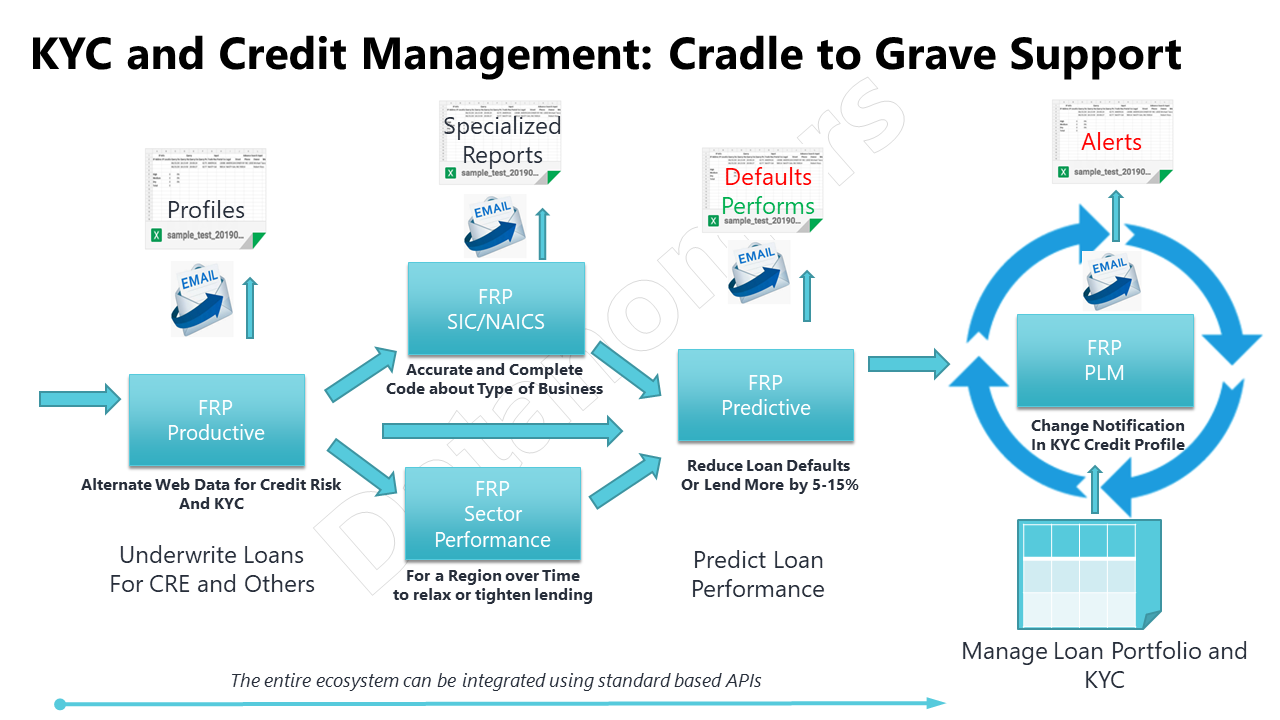

Financial Risk Profiler (KYC & Credit Management)

&

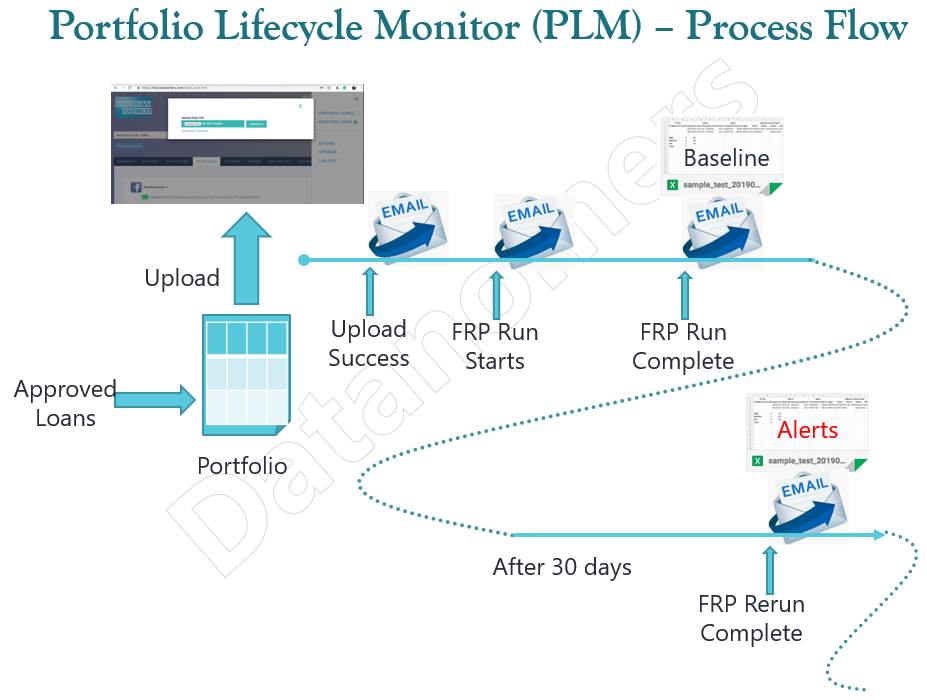

Portfolio Lifecycle Monitor (Automated Portfolio Reviews)

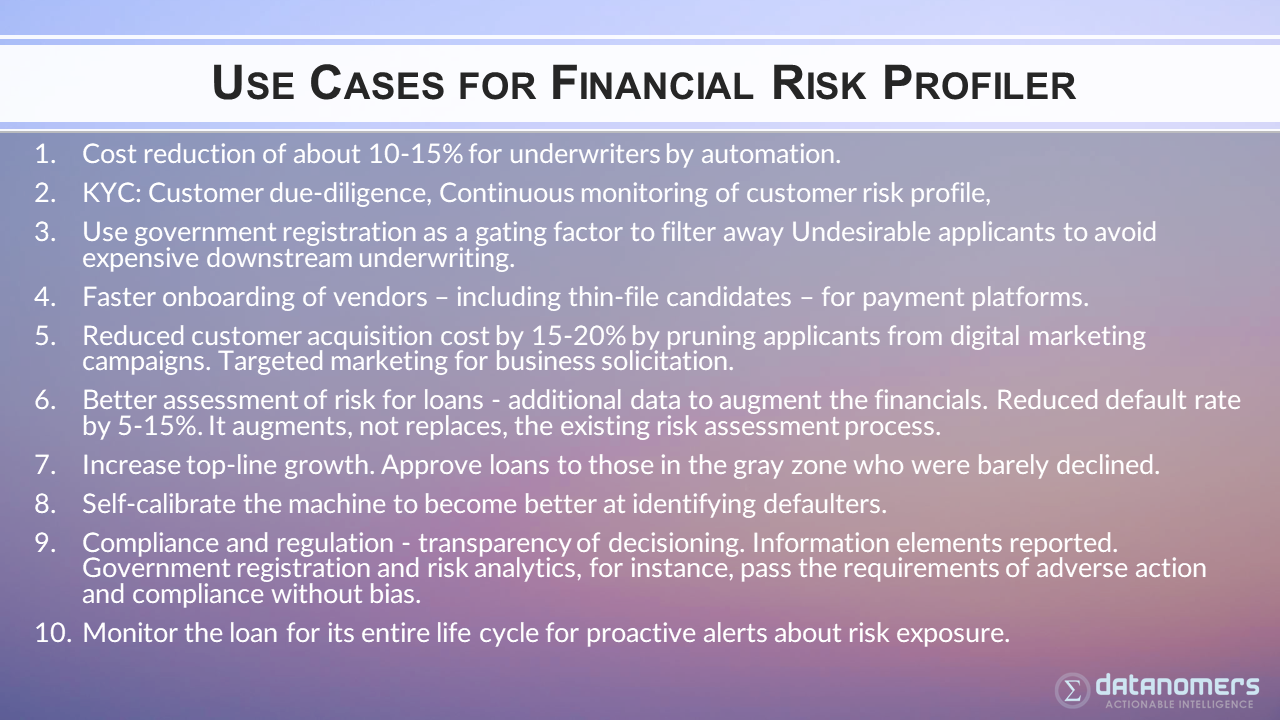

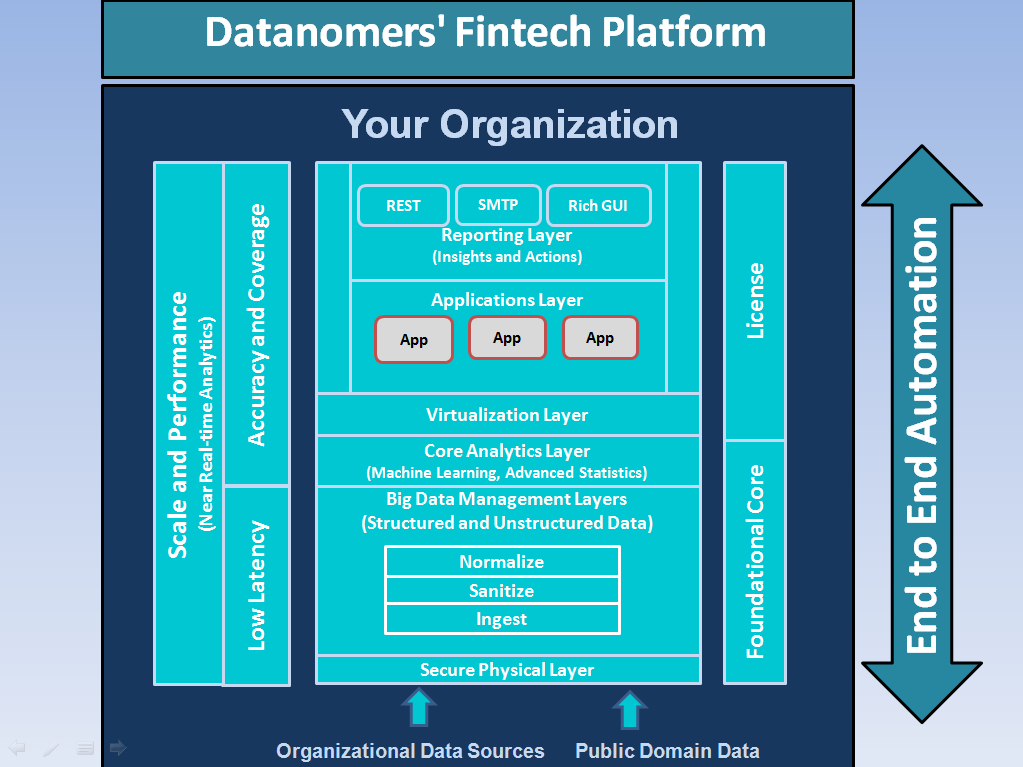

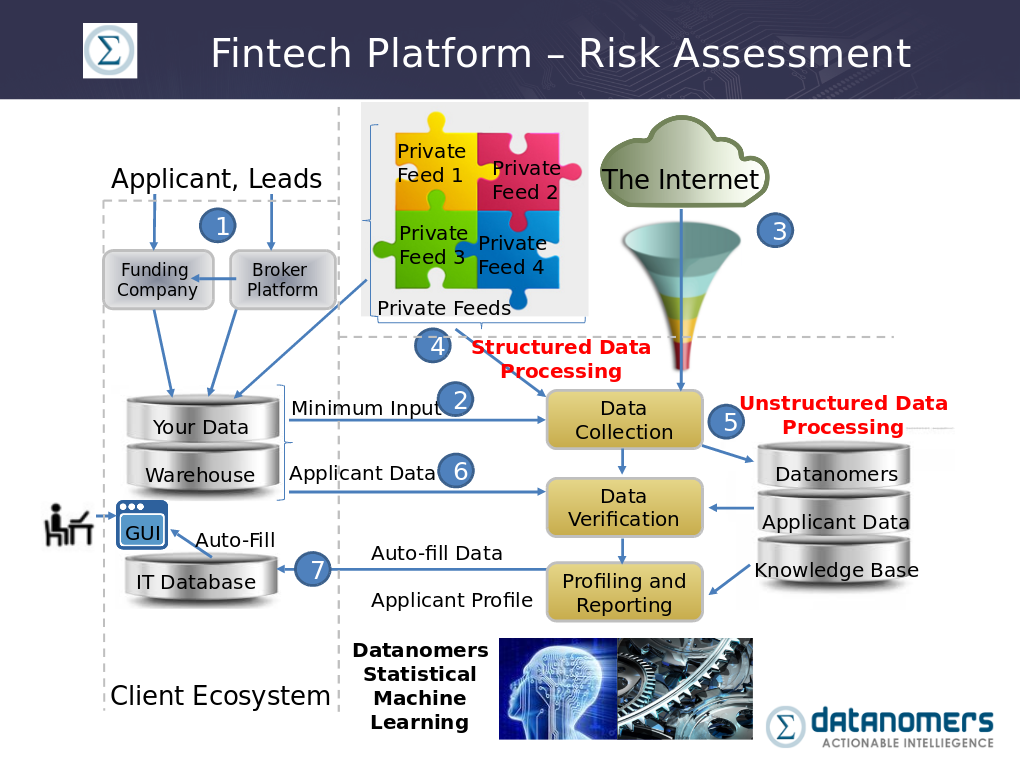

Datanomers has re-imagined how technology can help Financial Services Industry. Financial services industry is embracing disruption of established workflows and processes through technology very quickly. Datanomers' Fintech Platform helps leading Wall Street firms adopt Digital Revolution through automated sales and underwriting for loan originations. Underwriting is a complex process, manually-intensive with a lot of manual overhead and small loan originations can be very expensive. Manual underwriting requires underwriters to search public domain (Internet) for fraud, ownership, criminal records then manually analyze unstructured information for risk assessment. This is a complex process, automated in-part by intelligent machine which analyzes unstructured and semi-structured text. Intelligent machine’s technology = statistical machine learning + grammar-driven semantic analytics. Machine searches/crawls the web, indexes the retrieved information, analyzes for information and automatically enriches the sales/underwriter form with information about the applicant. Datanomers Technology automates underwriting & risk assessment function.